Business Insurance in and around Newton

Looking for protection for your business? Look no further than State Farm agent Dean Reed!

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide terrific insurance for your business. Your policy can include options such as a surety or fidelity bond, errors and omissions liability, and worker's compensation for your employees.

Looking for protection for your business? Look no further than State Farm agent Dean Reed!

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

Whether you own an art gallery, an antique store or a veterinarian, State Farm is here to help. Aside from remarkable service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

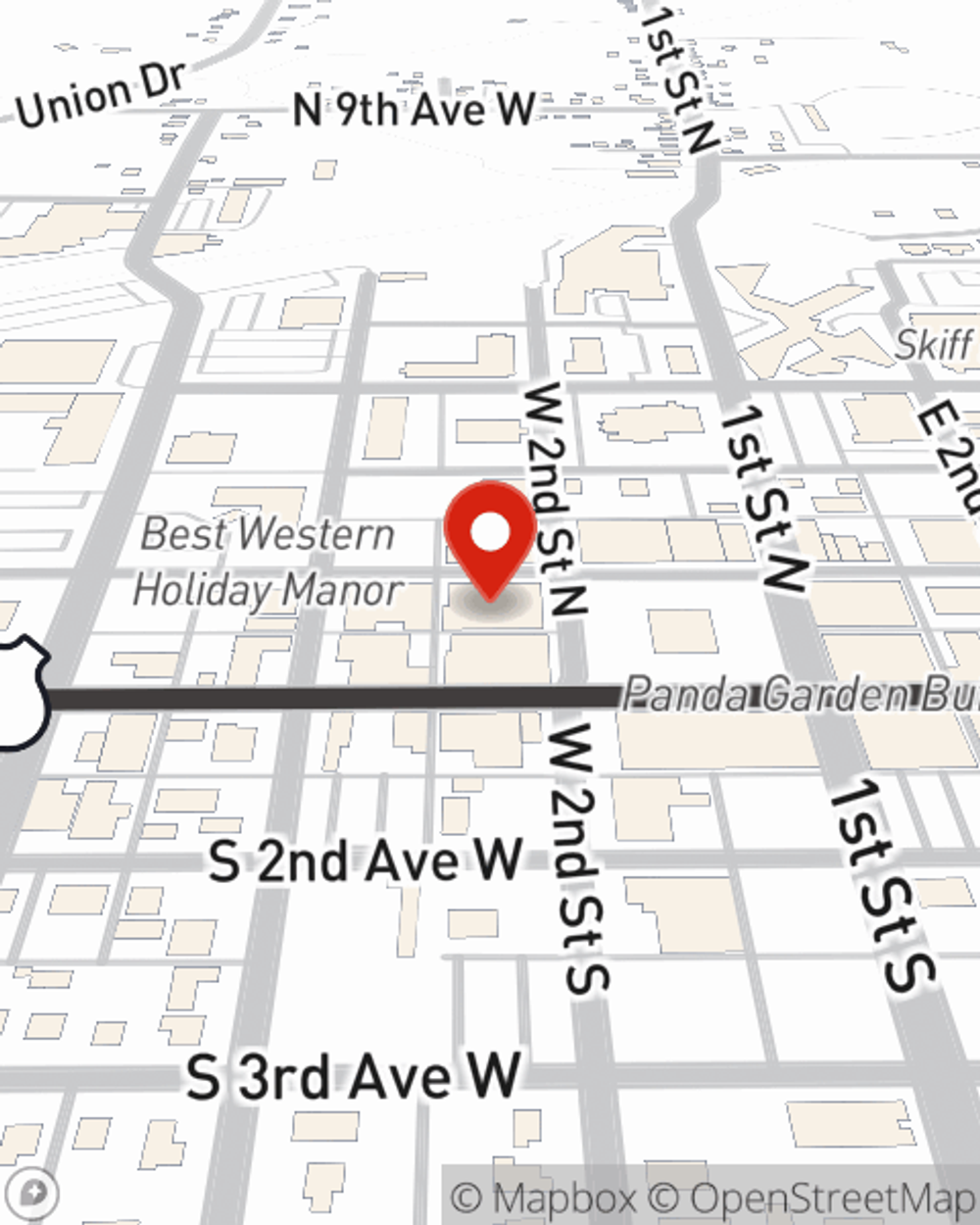

Ready to learn more about the business insurance options that may be right for you? Visit agent Dean Reed's office to get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Dean Reed

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.